Trading on the stock market is a gamble. A wrong mistake or bad day could cause a person to lose half their worth while a lucky guess could earn a person $100,000 in profit. Creating a new business involves even more risk, as it could either take off and turn into a multimillion-dollar company or result in a big waste of money and time.

Juniors Owen Crews and Mason Crews are competing in two competitions for DECA this year. The first one is titled Start Up Business Proposal, where they have to write an essay with an idea for a business and present it to judges. The second competition is titled the Stock Market Game, which simulates the real-world stock market and allows students to trade current stocks but fake money. This game is a part of the finance category in DECA and teaches students how to manage money. Districts for the Start-Up Business Proposal contest took place on Jan. 9. The Crews based their proposal off the Uber app and have titled their plan, “Chore Army.”

“If you look on the Uber [app] there are two options, you can either be the person that orders the car to drive you or you can be the person who drives people around for money,” Owen said. “[Our idea is] that but for chores. So if you’re an old person you can hire someone to fold your laundry or if you’re young you can become the person to fold somebody’s laundry. There’s infinite flexibility and [a person] can choose how much they get paid.”

The stock market game has two stages. The first stage involves trading stocks over the course of three months with a starting amount of 100,000 dollars. To compete in the Stock Market Game competitors go to a website where they put in their orders for the stock they want. The participants are responsible for researching the stocks and trends on their own.

“We go on a website called FINVIZ and we look for stocks there, it’s a stocks screener,” Owen said. “We also have a watch list or a bunch of watch lists on our own stocks to keep track of different stocks and so we can sort from high percentage to low percentage gain.”

According to Mason, researching stocks is a bit of a time commitment.

“Basically whenever I’m not doing work in class I’m on the FINVIZ app screen[ing] stocks,” Mason said. “I figure out what looks good and then I write it all down in a shared note we have. In total I’ve probably spent like three hours a day looking at stocks.

To effectively trade stocks, the team often discusses their ideas with each other and shares their research before making any decisions. Trading stocks as a team is all about collaboration, according to Owen.

“Usually we research stocks individually and then propose what stocks we think are a good idea,” Owen said. “We collaborate between each other to say ‘oh yeah that’s a good idea’ or ‘that’s not a good idea.’ That way we kind of have a second opinion on everything so we don’t make stupid mistakes.”

With their strategy in the stock market game, they are hoping for the percent representing the value of the stock to go down because it means they will earn more money. If it goes up then they lose money. According to Mason, working as a team makes it easier to spot the trends that will cause stocks to go down and stop them from buying them.

“There’s been a few times where I found something I thought would work and then Owen found some sort of trend or something that makes it look like it’s going to go up,” Mason said. “Then we don’t [buy] it and the next day it goes up 40%. Or I research the stocks for the day and I don’t find anything but Owen finds something that’s going to go up 40% the next day.”

The stock market app competitors use throughout the competition is all based on real stocks. The prices of every stock are exactly the same as they would be in real life but the app changes some of the rules of the real stock market.

“One big difference is that you can only do end of day trades,” Owen said. “So instead of trading and getting what [that] price is at that moment, you put in an order and it goes through at market close which is 3:00 p.m. CST or 4:00 EST. At market close you basically predict what you think that price is going to be at the end of the day in order to predict what the price is going to be at the end of the next day in order to get that change and hopefully make money off of it.”

The Crews have already completed the first stage of the contest and moved on to the second stage with a total of 600,000 dollars. The top 25 participants in the region with the most money advance to the second stage. The second stage is an international meet where competitors will present a written ten page portfolio essay to the judges. The money gained in the first stage doesn’t not matter, only their presentation is judged in this meet. This competition will take place on April 20th. The competitors weren’t given much instruction regarding this presentation, according to Owen.

“I have zero clue what to do, but we’ll figure it out,” Owen said. “[All we know is] that in the essay you write how you got different stocks, what your plan was going into it, and what you ended up doing. [You also explain] your biggest decisions, biggest money makers, biggest losses, and your overall gains and losses.”

Trading stocks is very unpredictable, according to Mason. This makes the Stock Market Game fun, hard, scary, and sometimes easy depending on the stock market of each day.

“Sometimes there’s just so many good options that we can’t decide which one to choose and then it turns out that it doesn’t matter because they all fail,” Mason said. “And then some days it’s like the worst thing you’ve ever seen. It’s all 50/50 gambles and we don’t know if we’re gonna make 50% the next day or if we’re gonna lose half our money. So it depends. Some days it’s really easy and some days it’s very scary.”

![Senior Jett Mckinney stores all the clothes in his own room, with half of it stored in his closet along with his personal clothes, and the rest taking up space in his room.

“There’s been times [when] there’s so much clothing stored here and it gets overwhelming, so I end up having to sleep somewhere else in the house,” Mckinney said.](https://cphswolfpack.com/wp-content/uploads/2025/11/DSC_0951-1200x800.jpg)

![Broadcast, yearbook and newspaper combined for 66 Interscholastic League Press Conference awards this year. Yearbook won 43, newspaper won 14 and broadcast took home nine. “I think [the ILPC awards] are a great way to give the kids some acknowledgement for all of their hard work,” newspaper and yearbook adviser Paige Hert said. “They typically spend the year covering everyone else’s big moments, so it’s really cool for them to be celebrated so many times and in so many different ways.”](https://cphswolfpack.com/wp-content/uploads/2025/05/edited-ILPC.jpg)

![Looking down at his racket, junior Hasun Nguyen hits the green tennis ball. Hasun has played tennis since he was 9 years old, and he is on the varsity team. "I feel like it’s not really appreciated in America as much, but [tennis] is a really competitive and mentally challenging sport,” Nguyen said. “I’m really level-headed and can keep my cool during a match, and that helps me play a bit better under pressure.” Photo by Kyra Cox](https://cphswolfpack.com/wp-content/uploads/2025/09/hasun.jpg)

![Bringing her arm over her head and taking a quick breath, junior Lauren Lucas swims the final laps of the 500 freestyle at the regionals swimming competition on date. Lucas broke the school’s 18-year-old record for the 500 freestyle at regionals and again at state with a time of 4:58.63. “I’d had my eye on that 500 record since my freshman year, so I was really excited to see if I could get it at regionals or districts,” Lucas said. “ State is always a really fun experience and medaling for the first time was really great. It was a very very tight race, [so] I was a bit surprised [that I medaled]. [There were] a lot of fast girls at the meet in general, [and] it was like a dogfight back and forth, back and forth.” Photo by Kaydence Wilkinson](https://cphswolfpack.com/wp-content/uploads/2025/03/Kaydence-2.7-23-edit-2.jpg)

![As her hair blows in the wind, senior Brianna Grandow runs the varsity girls 5K at the cross country district meet last Thursday. Grandow finished fourth in the event and led the varsity girls to regionals with a third place placement as a team. “I’m very excited [to go to regionals],” Grandow said. “I’m excited to race in Corpus Christi, and we get to go to the beach, so that’s really awesome.” Photo by Addison Bruce](https://cphswolfpack.com/wp-content/uploads/2025/10/brianna.jpg)

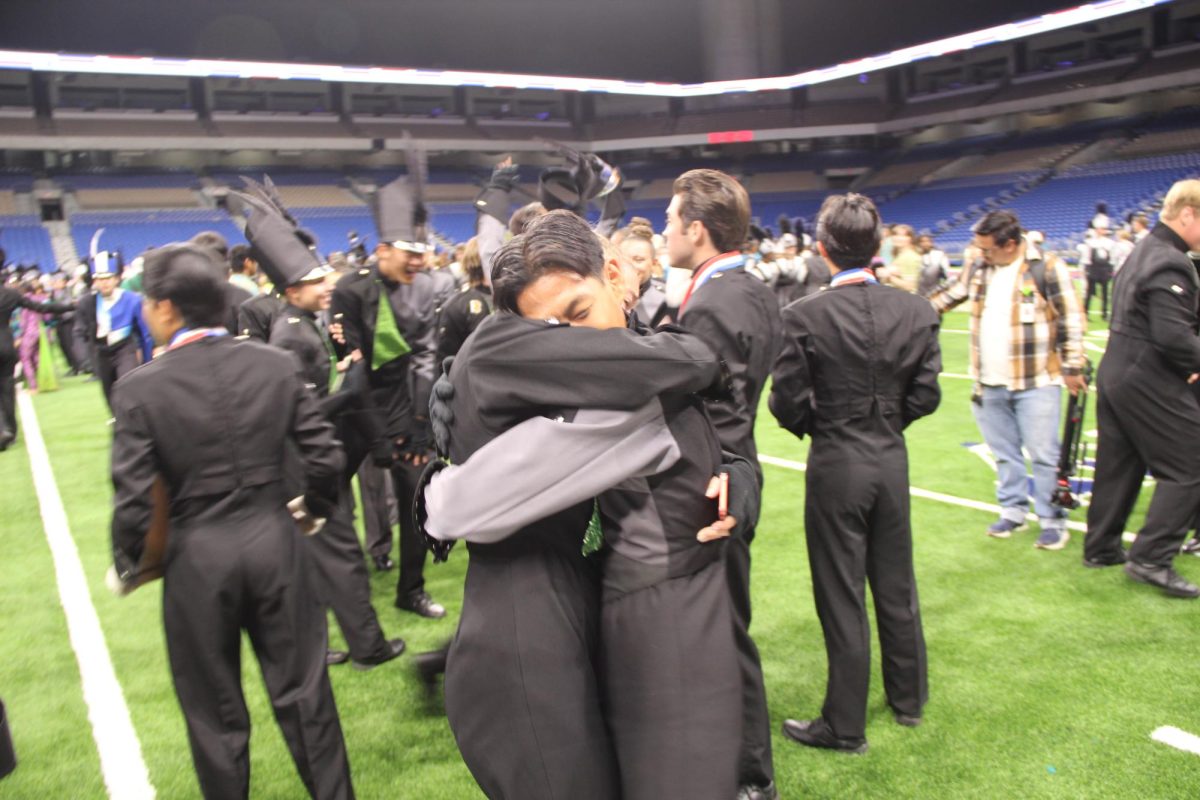

![Researching today's stock market and looking for trends, junior Mason Crews competes with his twin brother Owen Crews in the DECA Stock Market Game. According to Mason, working as a team makes it easier to spot trends that would negatively affect their value. “There’s been a few times where I found something I thought would work and then Owen found some sort of trend or something that makes it look like [a stock] is going to go up,” Mason said. “Then we don’t [buy] it and the next day it goes up 40%. Or I research the stocks for the day and I don’t find anything but Owen finds something that’s going to go up 40% the next day.”](https://cphswolfpack.com/wp-content/uploads/2023/12/image-of-crews.png)